Connecting state and local government leaders

But there are limitations. “There is no one single formula or tool that can give you all the answers,” says the executive director of the Utah Governor’s Office of Management and Budget.

It was no small adjustment. In late January, North Dakota legislative staff issued a revised oil and gas tax forecast for the state that lowered revenue estimates from the prior month by about $4 billion.

Estimates from last December pegged oil and gas tax revenues for North Dakota's 2015-2017 budget cycle at $8,322,330,000. The January forecast was just $4,268,140,000. Falling oil prices prompted the revised forecast. During the six-month period beginning in August 2014 and ending in January, the average price for a barrel of North Dakota crude dropped from $87.66 to $37.54, according to U.S. Energy Information Administration figures.

In the preceding years, the state’s oil and gas sector had experienced a boom, driven largely by the rise of hydraulic fracturing, commonly known as fracking.

While only a relatively small percentage of oil and gas taxes go to the North Dakota’s general fund, they do provide an important source of revenue for other accounts, such as education-related funds, and a resources fund, which helps cover the cost of water projects. Sizable chunks of the money are also allocated to counties, cities and tribes.

About a year before the revised oil and gas revenue forecast was issued, North Dakota state Sen. Mac Schneider attended a National Conference of State Legislatures event in Chicago.

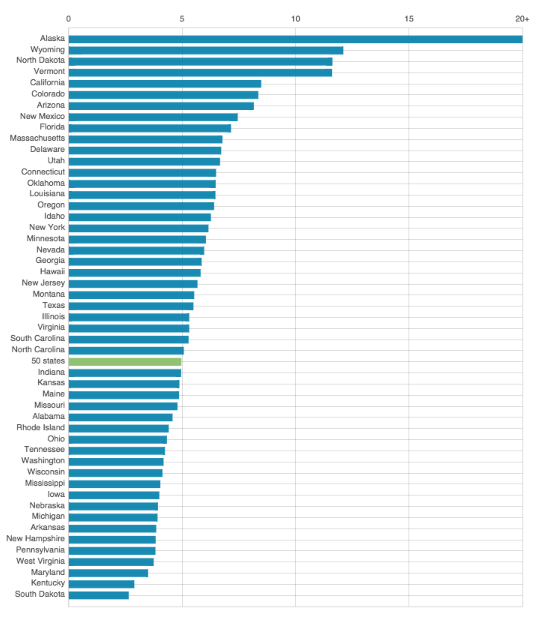

There he learned about research from the Pew Charitable Trusts that ranked North Dakota as one of the top U.S. states in terms of tax revenue volatility. In other words, the state had some of the highest levels of year-to-year variability in the amount of tax dollars it collected.

(via Pew Charitable Trusts)

For Schneider, the lowered revenue projections drove home Pew’s findings. “It became something other than an academic issue,” the state senator said in a recent interview.

Tax revenue volatility is not only an issue in North Dakota. As states emerge from the Great Recession, lawmakers and public officials around the U.S. are looking more closely at how volatile tax streams should guide decisions about budgeting and the amount of money that gets saved in reserve accounts, also called “rainy day funds.”

Some of these efforts are playing out legislatively. In late February, Schneider introduced a concurrent resolution that called for North Dakota to study how vulnerable it is to volatile tax streams. The resolution was shot down on March 13 during a Senate verification vote.

But similar measures have had more traction in other states.

On April 7, Nebraska’s legislature approved a bill requiring the state’s legislative fiscal analyst to issue a “revenue volatility report” every two years beginning in 2016. The report will look not only at the variability in tax streams, but also at federal funding sources that could change, and assess the adequacy of current and projected reserve fund balances given these factors.

A bill is also under consideration in the Oregon state legislature that would create a new task force on reserve funds, consisting of lawmakers from the state’s House and Senate.

And in Utah, the Governor’s Office of Management and Budget plans to run a series of new “stress tests” to see how different revenue scenarios would affect the state’s finances.

Pew’s policy director for state fiscal health and economic growth, Robert Zahradnik, notes that states looking at previous revenue trends is not a new phenomenon. But more recently, he said, they’ve begun to do so in a new context.

One key difference is that states are increasingly trying to use more of what they’ve learned from those past trends to inform decisions about reserve accounts.

“It’s been rare that that look-back has been tied, sort of explicitly, to what their savings policy is going to be going forward,” he said. “I think there’s more interest in it,” Zahradnik added, “because the Great Recession was so difficult on states.”

Analyzing revenue trends can help show whether an uptick in one type of tax collections is in line with previous growth rates, or if it is an anomaly. It can also offer insight into whether a certain source of revenue—a state’s corporate tax for instance—is historically erratic. Additionally, trends can show if a state’s overall tax revenue tracks with broader economic ups and downs, or moves to its own localized rhythm.

All of this information can prove useful for budget and reserve fund planning. But using past revenue trends to draw conclusions about where a state’s finances are headed can also be tricky.

“I think it’s part of the answer, but not the whole answer,” said Kristen Cox, the executive director of the Utah Governor’s Office of Management and Budget.

Beginning in 2009, the office began working with the state’s Office of the Legislative Fiscal Analyst to assess revenue volatility and to provide recommendations for managing Utah’s rainy day fund balance. And last year, for the first time, a report the two offices co-produced compared revenue estimates for each tax the state collects against 15-year trends.

Cox said this type of analysis can be helpful in some ways, but warns that basing estimates of future revenue on past trends alone can be problematic for a number of reasons. For starters, it’s possible to analyze trends in different ways, using linear or nonlinear techniques. Trends are also complicated by year-to-year policy changes, and structural economic shifts.

A trend analysis by itself, Cox said, is akin to a family planning their household budget by looking at 15 years of income without considering factors like savings, debt or raises.

This is where a stress test can help, she said. The testing method her office is working on will involve first determining the probability that various fiscal scenarios could unfold. These scenarios might involve different streams of tax revenue rising or falling.

It will then be possible to run models to look at what would happen if the most likely scenarios actually took place. How would they affect Utah’s finances? Would the state have enough reserve funds on hand based on those predictions to withstand each scenario?

“We think budget stress-testing will give us a forward-looking view, trend gives us a historical looking view, and between the two we hope to get a more robust picture of what’s happening,” Cox said. But still she cautioned: “We never think we’ll be able to perfectly predict.”

The Nebraska State Capitol in Lincoln. (Photo by Henryk Sadura / Shutterstock.com)

Planning for the Next Downturn

Predictions are made harder by the number of budget curveballs that state governments can face.

For instance, Nebraska is on the hook for $15 million in reimbursements to the federal government. This is because a state agency failed to properly document federal dollars directed toward child welfare services. The repayment will come out of the state’s rainy day fund, according to the Nebraska unicameral legislature’s Appropriations Committee chairman, Heath Mello.

Mello introduced the newly approved bill that calls for the state’s legislative fiscal analyst to take a biannual look at the volatility of tax revenue, changes in federal funding, and the adequacy of Nebraska’s rainy day fund. The state senator said that similar work has been underway since he took over as Appropriations Committee chair in 2013 and that the bill “really just puts it in statute.”

While leading-up the committee, Mello has targeted a reserve fund balance equal to about 16 percent of general fund revenues. When he took office in 2009, just after the onset of the Great Recession, Mello said the fund balance was close to the 17 percent mark.

“I would say the state was in a more envious position than most other states because we had built a rainy day fund,” he said.

But Mello added: “We wouldn’t have been able to weather the economic recession without the assistance of the federal stimulus.” When the next downturn arrives, he’s skeptical that the same federal lifeline will be available.

Therein lies part of the motivation for his recently passed bill.

“LB33 if anything, is a more strategic planning tool to ensure that we stay focused on planning for the future,” Mello said, referring to the bill number. “I don’t anticipate the federal government will ever come in and bail out state governments the way they did in 2009.”

While getting caught in a recession with a wimpy rainy day fund might be one risk for states, Utah’s Cox believes that stashing away excessive money in reserve accounts can also be a problem, because it can reduce the amount of cash a state has freed up for other priorities.

That said, she understands how budget and program cuts during the last recession might have left some lawmakers a bit spooked.

“I think a lot of folks were scarred through that experience,” she said. “Because of that there’s almost a pendulum swinging to the other side to put away more money.”

“We just have to make sure we’re not setting aside too much,” Cox added.

At the end of March, Utah Gov. Gary Herbert signed legislation into law that raised reserve fund contribution limits for the state.

Utah can now contribute an amount equal to 9 percent of the total general fund to its general reserve account, up from 8 percent. The total the state can put in its education reserve fund also went up, rising to 11 percent, from 9 percent, of Education Fund appropriations.

Going forward, Cox hopes the stress testing her office has planned will provide information to further dial in these percentages.

But even the best tests have their limitations. “There is no one single formula or tool that can give you all the answers,” Cox said. “It takes a variety of tools to get the full picture.”

For now, Schneider, the state senator from North Dakota, is not too worried about the decline in oil and gas tax collections. He’s quick to point out the state general fund’s lack of reliance on these revenue sources.

Ongoing general fund spending in North Dakota is limited to $300 million in oil and gas tax revenues under state law, according to Gov. Jack Dalrymple’s 2015-2017 executive budget. For the budget cycle, the governor recommended $7,232,580,330 of general fund spending.

Although an account like the resources trust fund might “get absolutely socked” by a plunge in oil prices, Schneider stressed that, overall, the state is in a sound financial position.

“It’s different from the ridiculous growth we’ve had in the past couple of years, but at the same time we’re not pushing the panic button,” he said.

Asked about why his resolution failed, he said that he believed some of his senate colleagues might have seen it as an attempt to second guess past work lawmakers had done that was related to reserve funds. But that, he said, was not his intention at all.

“I don’t think we’ve done a bad job guarding against revenue volatility,” Schneider said. “But I certainly think there’s always room to look to improve.”

NEXT STORY: New York City Residents Getting Direct Say in How $25 Million Is Budgeted